Housing

4. Profile of the Region

Housing

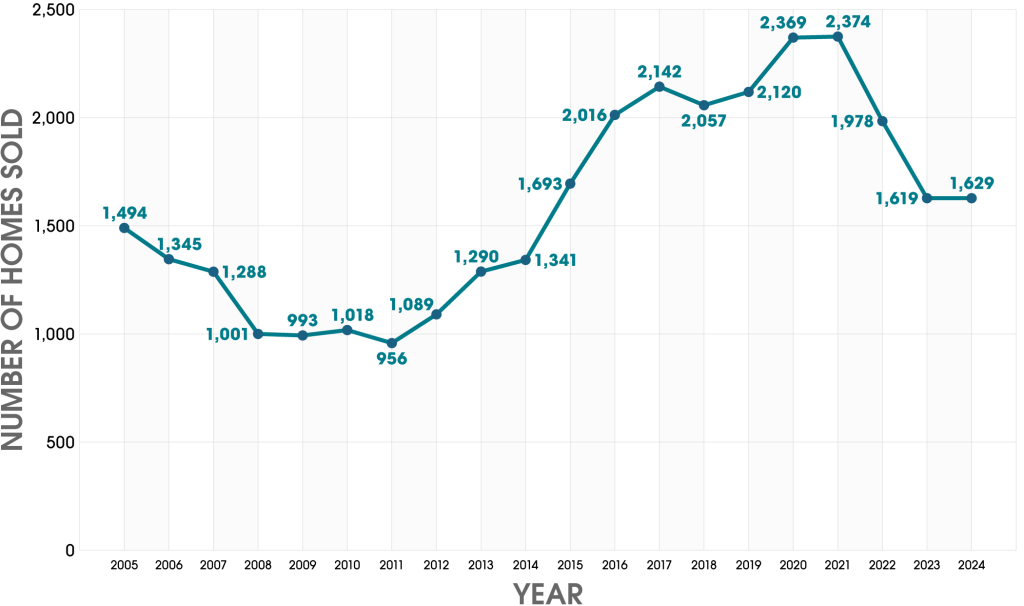

Existing single family home sales in Ulster County between 2011 and 2020 continued to increase as the economy continued to recover from the 2008 recession (Figure 4.11). A sharp decline was seen after the COVID-19 pandemic as home sales pulled back to mid-2010s levels due to increasingly rising sales prices and interest rates. The data shows a leveling out in 2024 as home sales increased slightly from 2023 after three straight years of sharp declines indicating an improvement. However, elevated sales prices remain challenging for residents, with the median sales price increasing by 47% between 2018 and 2023, from $262,000 to $385,000.

Rental costs in Ulster County continue to outpace inflation and growth in median income. In 2023, 46% of Ulster County renters were housing-cost burdened, defined as paying 30% or more of their income on housing costs, while 26% of Ulster County renters were severely cost-burdened, defined as spending 50% or more on housing costs.

Table 4.2: Ulster County Housing and Occupancy, All Units, 2018-2023

2018 | 2023 | ||||

# Units | Homeowner Vacancy Rate | Rental Vacancy Rate | # Units | Homeowner Vacancy Rate | Rental Vacancy Rate |

84,874 | 2.0% | 5.3% | 86,78 | 1.7% | 4.0% |

US Census American Community Survey 5-Year Estimates – 2018 & 2023, Housing Characteristics, Ulster County, New York State (Table CP04).

Vacancy status has long been used as a basic indicator of the housing market and provides information on the stability and quality of housing for certain areas. The data is used to assess the demand for housing, to identify housing turnover within areas, and to better understand the population within the housing market over time. As shown in the table below, overall homeowner vacancy rate decreased to 1.7% in 2023, and rental vacancy decreased to 4.0% from 5.3% in 2018.

Anticipated New Housing and Commercial Developments in Ulster County

There are numerous “major” developments (defined here as exceeding 10,000 sq. feet) in Ulster County that are at various phases in the approval process. Although the ultimate construction of some of these projects remains questionable, the LRTP assumes that housing and commercial projects will be completed within their build-out forecasts and are within the LRTP’s planning horizon.

Regional traffic and transportation demand will grow if full build-out of the projects listed below is realized.

Table 4.3: Anticipated Major Developments Pending or Underway in Ulster County

|

Type |

# of Projects Pending or Underway |

Amount of Development |

|

Commercial (Office/Retail) |

8 |

102,500 square feet |

|

Hotel/Lodging |

9 |

732 hotel rooms/units |

|

Industrial |

4 |

890,500 square feet |

|

Mixed Use (residential/hotel/commercial) |

11 |

2,339 residential units; 532 hotel rooms/units; 949,000 square feet commercial space |

|

Residential |

23 |

2,270 residential units |

|

Recreational |

1 |

77,000 square feet |

Source: Ulster County Planning Department