4. Profile of the Region

4. Profile of the Region

Ulster County has a rich natural, cultural, and commercial history that continues to evolve. The County has experienced reoccurring periods of significant growth followed by subsequent decline and recovery since its settlement in the early 1600’s. The region continues to improve its economic outlook as evidenced by increases in employment, improvements in the real estate market, and increases in sales and hotel tax receipts and the strengthening of its ties to the New York Metropolitan area. However, municipal tax caps and lack of growth in personal income continue to place strains on both municipal and family budgets with increases in housing costs outpacing income growth.

Transportation availability and cost is also a major concern for many households. This underscores the need to rethink how mobility can be improved within municipal and family budgets in a manner that allows the region to remain competitive and sustainable.

Population

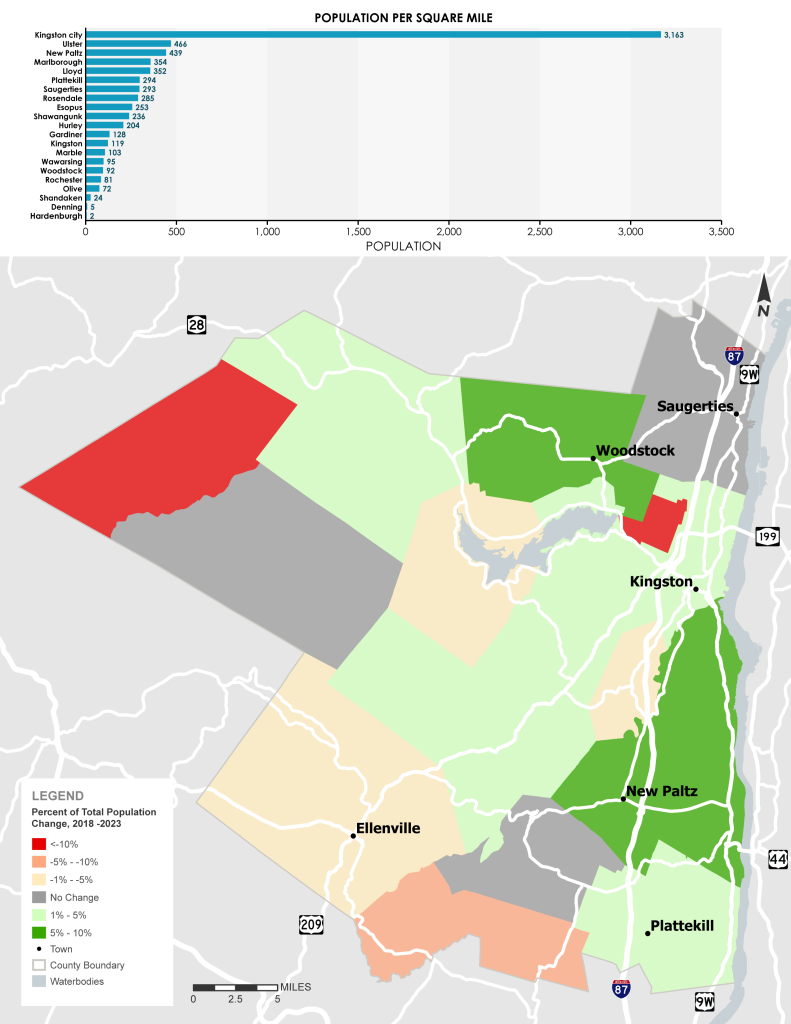

According to the 2023 American Community Survey – the latest estimate of demographic statistics available – the population of Ulster County is estimated at 182,109, which is up 2.1% since the 2020 Census but generally in line with the population estimates from the 2010 Census.

An overview of historic population trends in Ulster County reveals steady but declining growth rate from 1950 through to the 2010 decennial census. A strong 28% increase between 1950 and 1960 stands in stark contrast to the less than 3% increase between 2000 and 2010 (Figure 4.2) and the estimated 2.3% decline between 2010 and 2020. The population recovered in the postCovid era with a 2.1% increase between 2020 and 2023 to almost match 2010 population levels.

An overall declining rate of population growth can be attributed to four primary factors: mortality, out-migration among older adults, a declining birth rate, and an inability to retain young people as they enter adulthood.

It is challenging to predict Ulster County’s population over several decades with any level of certainty. In general areas south of New Paltz are likely to see increases in population over time due to proximity to employment centers outside of the County while the City of Kingston area enjoys renewed interest due to costs, quality of life, and opportunities for networking with others from the metropolitan area.

Title VI Demographic Characteristics

Labor and Employment

Unemployment rate in the Kingston Metropolitan Statistical Area (MSA), which includes the entirety of Ulster County, remains below the state rate and has continued to improve since the pandemic. Concurrently, however, the County’s labor force has decreased slightly since 2018, very likely a result of out-migration as well as from retirements as people age and chronically unemployed workers permanently dropping out of the labor force. As described by the New York State Department of Labor (DOL) in their monthly labor profile for the Hudson Valley, for the 12-month period ending in January 2025, private sector employment in the Hudson Valley increased by 15,200 or 1.9 percent, to 819,000.

In 2024 the DOL published its Significant Industries report for the Hudson Valley, providing a description of “priority industries” on which local workforce investment boards should concentrate their workforce development resources. Significant industries identified for the Hudson Valley are listed here:

- Accommodation and food service

- Construction

- Manufacturing

- Transportation and warehousing

- Information

- Professional and business services

- Educational services

- Health care

- Arts, amusement, and recreation

The top employment sectors in Ulster County include Health Care and Social Services, Retail Trade, Accommodation and Food Services, Educational Services, and Public Administration. The sectors showing the most notable gains in total employment share over time include Educational Services and Manufacturing. Many of these industries are still recovering from the COVID-19 pandemic as shown in Figure 3.9 as the 2018 levels are often higher than 2023. However, industries such as Accommodation and Food Services are expected to continue to recover beyond pre-pandemic levels.

Of the top employers in Ulster County reported in 2020, the majority are concentrated in the greater Kingston area, but the county’s two largest employers – SUNY New Paltz and Mohonk Mountain House – are located in the greater New Paltz area and together create approximately 3,700 jobs. By comparison, 37 large employers in the Kingston area in 2020 accounted for nearly 10,000 total jobs, while the Ellenville area reports only three firms or organizations that employ 200 people or more. When reviewed by industry classification, the areas of Health Care, Public Administration, Education, Accommodation & Food Services, and Retail account for 81% of the county’s top employers, or just over 16,000 employees.

Labor and Employment Snapshot of Ulster County

|

Category |

Jan 2018 |

Jan 2023 |

Jan 2025 |

|

Resident Civilian Labor Force |

87,400 |

85,000 |

86,200 |

|

Employed |

83,000 |

81,900 |

82,800 |

|

Unemployed |

4,400 |

3,100 |

3,400 |

|

Kingston MSA Unemployment Rate |

5.1% |

3.7% |

4.0% |

|

NYS Unemployment Rate |

4.9% |

4.4% |

4.6% |

|

US Unemployment Rate |

4.0% |

3.5% |

4.0% |

Housing

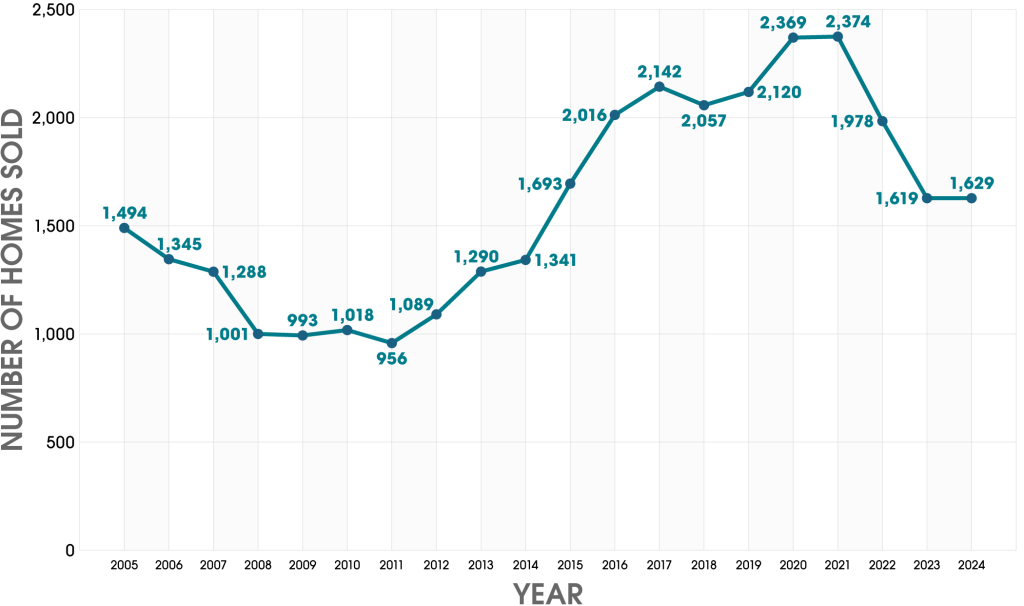

Existing single family home sales in Ulster County between 2011 and 2020 continued to increase as the economy continued to recover from the 2008 recession (Figure 4.11). A sharp decline was seen after the COVID-19 pandemic as home sales pulled back to mid-2010s levels due to increasingly rising sales prices and interest rates. The data shows a leveling out in 2024 as home sales increased slightly from 2023 after three straight years of sharp declines indicating an improvement. However, elevated sales prices remain challenging for residents, with the median sales price increasing by 47% between 2018 and 2023, from $262,000 to $385,000.

Ulster County Housing and Occupancy, All Units, 2018-2023

2018 | 2023 | ||||

# Units | Homeowner Vacancy Rate | Rental Vacancy Rate | # Units | Homeowner Vacancy Rate | Rental Vacancy Rate |

84,874 | 2.0% | 5.3% | 86,78 | 1.7% | 4.0% |

Rental costs in Ulster County continue to outpace inflation and growth in median income. In 2023, 46% of Ulster County renters were housing-cost burdened, defined as paying 30% or more of their income on housing costs, while 26% of Ulster County renters were severely cost-burdened, defined as spending 50% or more on housing costs.

Vacancy status has long been used as a basic indicator of the housing market and provides information on the stability and quality of housing for certain areas. The data is used to assess the demand for housing, to identify housing turnover within areas, and to better understand the population within the housing market over time. As shown in the table below, overall homeowner vacancy rate decreased to 1.7% in 2023, and rental vacancy decreased to 4.0% from 5.3% in 2018.

Anticipated New Housing and Commercial Developments in Ulster County

There are numerous “major” developments (defined here as exceeding 10,000 sq. feet) in Ulster County that are at various phases in the approval process. Although the ultimate construction of some of these projects remains questionable, the LRTP assumes that housing and commercial projects will be completed within their build-out forecasts and are within the LRTP’s planning horizon.

Regional traffic and transportation demand will grow if full build-out of the projects listed below is realized.

Anticipated Major Developments Pending or Underway in Ulster County

Type | # of Projects Pending or Underway | Amount of Development |

Commercial (Office/Retail) | 8 | 102,500 square feet |

Hotel/Lodging | 9 | 732 hotel rooms/units |

Industrial | 4 | 890,500 square feet |

Mixed Use (residential/hotel/commercial) | 11 | 2,339 residential units; 532 hotel rooms/units; 949,000 square feet commercial space |

Residential | 23 | 2,270 residential units |

Recreational | 1 | 77,000 square feet |